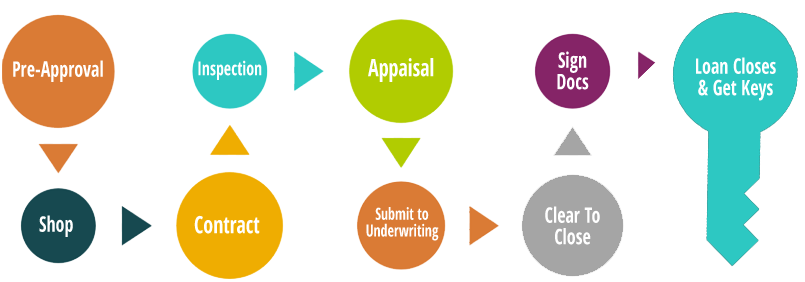

Here is our process.

It’s awesome! Right ?

Pre qualification & Pre-Approval

Borrowers need to submit all that is needed on the check list so a processor or underwriter can approve a maximum loan amount and terms for the loan.

Agreement & Compliance Signatures

Negotiate rate and we order the compliance package for all borrowers to sign and return (done electronically).

Verification Process

All verifications are ordered and appraisal is set up with the client to do an inspection of the property.

Submitting to Underwriting

Once all the verification and appraisal are received, we package file for submission to the underwriter. They approve file with conditions and we lock the file (meaning lock in the rate to secure the loan doc’s).

Meeting All Conditions

All conditions are met and the file gets a “Clear To Close” From the underwriter and we order the loan doc’s.

Signing of the Loan Documentation

All borrowers sign the loan doc’s at either Escrow or a Mobile Notary and loan doc’s are then sent back to the funding office for confirmation and wiring of funds to close the transaction.

Loan Closing

Loan closes and records and borrowers get Keys to home, cash out if it is a refinance, or line of credit on a home equity loan.

Time Line

1 week from pre approval to appraisal being received.

1 week from submission to underwriting and full approval of loan.

1 week to meeting all conditions and getting loan doc’s.

1 week to closing of loan….